What is a salary deduction letter?

This is a letter that is sent to the staff by the company for the deduction of the salary. The deduction can be due to financial or economic crises, pandemic conditions, and massive business loss. Salary deduction letter always leads to deduction in wages. There can be several other reasons for writing the letter. For instance, the irregularity of the staff, unprofessional behavior of the employee, failing to meet the target(s), or failure to cope-up with the company’s policies. A deduction can be a certain amount or percentage of salary. i.e., [X]% of the gross or basic salary.

Significance of a salary deduction letter:

A salary deduction can be pivotal in a business environment as a business is always at the stake of loss. A massive loss in business can make the company take such decisions as a salary deduction. This letter is evidence of professionalism in an organization as it gives room to its employee for the process of deduction through mutual consent.

Sometimes it is important to take any action against the employee’s unprofessionalism and non-compliance to the company’s policies. It can also be sent for issues like uninformed absences, late coming, and early goings. To get maximum output from the workers, a warning letter can be issued before sending the letter of salary deduction. However, it will not be counted as a salary deduction letter.

Writing a salary deduction letter:

Writing a salary deduction letter can extremely be a tough job as money is centered on the relationship between an employee and employer. The deduction can scar the efficiency of an employee which can result in worsening the situation of crisis and economic stability of the company. However, the letter is highly significant to train the employee to showcase professional mannerism. Here are a few points that you can follow while writing a salary deduction letter without being rude or unprofessional:

1. Maintain the positive tone

A negative tone can ruin the professional bond of an employer and employee. It can also damage the sanctity and reputation of an organization. Make sure you are using a positive tone even when conveying a negative message. Use euphemistic expressions where applicable.

2. Give concrete reasons for deductions

Do not take all the blame yourself when it is not your fault. In the lieu of the company’s policies give concrete reasons for the deductions. Proper and logical argumentation can get you to a professional debate.

3. Provide evidence of the loss where possible

If the deduction is being made on some kind of business loss, do not shy to share the evidence. The workplace is your second home and employees are your family. They will understand the situation and will stand by you if communicated properly. Share the balance sheets or tell them about the economic crisis you are facing. Moreover, do not forget to offer them a temporary or permanent layoff.

4. Be precise but not too much

To condense a thought is a good idea but not applicable when it comes to salary deduction. Always explain your viewpoint and expectations from the employee. Try to keep your letter short and crisp but never forget to give reasons for the deduction. A salary deduction letter is meant to be explanatory. Otherwise, you will be bombarded with complaint letters in response.

5. Letter should be legally complaint

Always remember! You cannot unlawfully deduct the salary of an employee. Otherwise, it will result in a claim against you. In the case of salary deduction, share the proof of the legal bond in writing.

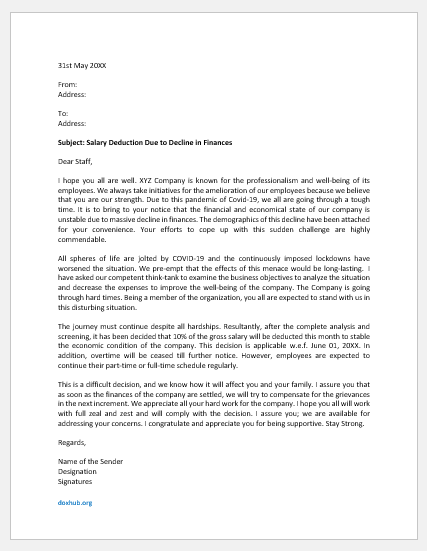

Sample Letter

31st May 20XX

From:

Address:

To:

Address:

Subject: Salary Deduction Due to Decline in Finances

Dear Staff,

I hope you all are well. XYZ Company is known for the professionalism and well-being of its employees. We always take initiatives for the amelioration of our employees because we believe that you are our strength. Due to this pandemic of Covid-19, we all are going through a tough time. It is to bring to your notice that the financial and economical state of our company is unstable due to massive decline in finances. The demographics of this decline have been attached for your convenience. Your efforts to cope up with this sudden challenge are highly commendable.

All spheres of life are jolted by COVID-19 and the continuously imposed lockdowns have worsened the situation. We pre-empt that the effects of this menace would be long-lasting. I have asked our competent think-tank to examine the business objectives to analyze the situation and decrease the expenses to improve the well-being of the company. The Company is going through hard times. Being a member of the organization you all are expected to stand with us in this disturbing situation.

The journey must continue despite all hardships. Resultantly, after the complete analysis and screening, it has been decided that 10% of the gross salary will be deducted this month to stable the economic condition of the company. This decision is applicable w.e.f. June 01, 20XX. In addition, overtime will be ceased till further notice. However, employees are expected to continue their part-time or full-time schedule regularly.

This is a difficult decision, and we know how it will affect you and your family. I assure you that as soon as the finances of the company are settled, we will try to compensate for the grievances in the next increment. We appreciate all your hard work for the company. I hope you all will work with full zeal and zest and will comply with the decision. I assure you; we are available for addressing your concerns. I congratulate and appreciate you for being supportive. Stay Strong.

Regards,

Name of the Sender

Designation

Signatures