An insurance policy provides financial security in case of medical sickness, accidents, theft or other unforeseen circumstances. When you buy a policy, you have a right to make a claim as per your requirements. For instance, you may request your insurance company to cover your medical bills or pay for your automobile repairs according to what policy you have purchased. In order to make this claim formally, you need to write a letter.

Before writing the letter, you may call your agent or the insurance company’s representative regarding your claim. Ask him for guidance about what details need to be provided by you. Include these details in your letter along with the necessary documentation.

Moreover, it is also important to go through your policy again before making an official claim to the insurance company. Go through all the conditions and make sure the policy covers the expenditure for whatever has happened to you. You may then crosscheck with your agent over the phone before finally drafting the letter.

Here are some tips to help you make a formal claim with your insurance company.

- State the Purpose

Explain why you are writing to your insurance agent or company. State that you want to make a claim in accordance to your insurance policy. Briefly describe the damage for which you wish to make the claim. This comprehensive explanation will be the introduction of your letter. It will provide the necessary information to your insurance agent so that he understands the purpose you are contacting the company for. Elaboration of the important details will follow next.

- Provide Details of the Damage

It is necessary to provide the details of the damage in order to justify your claim. This is because insurance policies consist of various conditions as well as limitations. You have to prove to the insurance company that your claim is valid. At times, the company may send its own representative to you in order to inspect the damage. The purpose of doing so is to ensure that the damage has not been done deliberately for the sake of claiming the insurance money. Therefore, it is important to give a detailed description in your letter and convince your insurance agent that your policy should cover the required expenditures.

In addition, include all important information and data including dates, repair estimates or medical expenditures. You should also state that you are aware of the deductible in case it is mentioned in the policy.

- Mention your Claim with Supporting

Documentation

You should enclose all relevant documents with your letter. For instance, copies of medical bills, repair estimates or receipts need to be attached with the letter as a proof. The total amount you wish to claim is based on this proof.

- Demand for a Quick Response

Although your insurance company is bound to pay your valid claim, the process may take time. However, you may demand for the procedure to be carried out on priority for you so that you can receive your claim soon. This is particularly important in situations when you need the payment urgently in order to go ahead with any repairs or replace stolen or damaged items urgently. Mention your need and state the reason why you require an urgent payment.

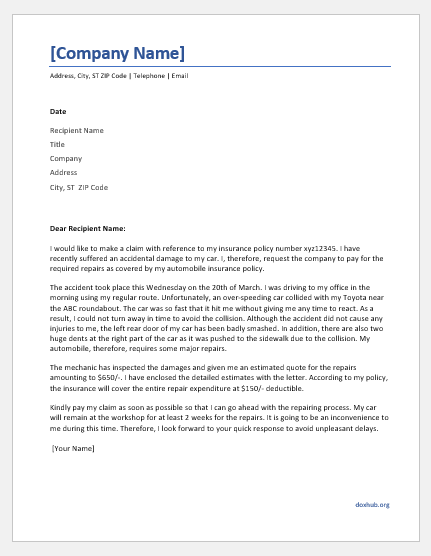

Sample Letter

I would like to make a claim with reference to my insurance policy number xyz12345. I have recently suffered an accidental damage to my car. I, therefore, request the company to pay for the required repairs as covered by my automobile insurance policy.

The accident took place this Wednesday on the 20th of March. I was driving to my office in the morning using my regular route. Unfortunately, an over-speeding car collided with my Toyota near the ABC roundabout. The car was so fast that it hit me without giving me any time to react. As a result, I could not turn away in time to avoid the collision. Although the accident did not cause any injuries to me, the left rear door of my car has been badly smashed. In addition, there are also two huge dents at the right part of the car as it was pushed to the sidewalk due to the collision. My automobile, therefore, requires some major repairs.

The mechanic has inspected the damages and given me an estimated quote for the repairs amounting to $650/-. I have enclosed the detailed estimates with the letter. According to my policy, the insurance will cover the entire repair expenditure at $150/- deductible.

Kindly pay my claim as soon as possible so that I can go ahead with the repairing process. My car will remain at the workshop for at least 2 weeks for the repairs. It is going to be an inconvenience to me during this time. Therefore, I look forward to your quick response to avoid unpleasant delays.