Applications for a loan may take a long time to get approved. A bank must verify and perform other essential processes before sanctioning the loan. However, once a loan has been approved, the bank informs its client and discusses the relevant terms and conditions. For this purpose, the bank writes a letter to the client that includes the following information:

Deliver the Approval News with Pleasure

Begin the letter by informing the client that his loan has been approved. Since this is happy news for the reader, express your own pleasure as well. This is a good way of building your relationship with your client by showing politeness.

Provide the Loan Details

Mention the specific details about the loan, including the principal amount, interest rate, and payback instalments. Moreover, provide the exact dates when the client needs to make the payments.

Discuss Terms and Conditions

Essential terms and conditions related to the sanction are summarized in a separate document with the letter. Discussing your company’s amortization policy would be best to help the client understand the legal rules about paying the loan back.

Request for Compliance with the Rules

Although it is understood that legal rules are binding for the involved parties in case of all types of agreements, you should still emphasize the importance of following the bank’s policies. State what action you can take if the client breaks any rules. For instance, inform the client that he will have to pay a fine or face legal action in case of non-payment of the monthly instalments.

Offer Further Assistance

Explain how or when your client may contact your wife or you for assistance.

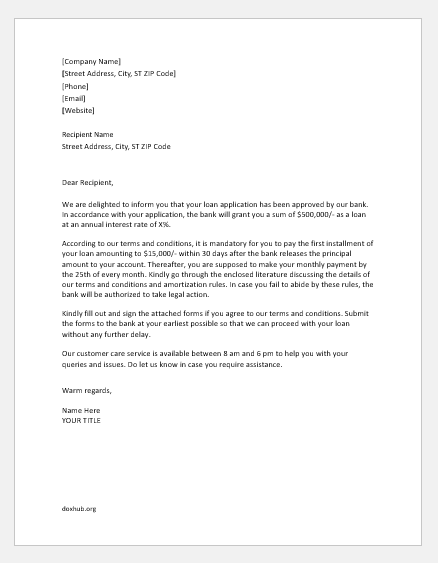

Sample Letter

We are delighted to inform you that our bank has approved your loan application. In accordance with your application, the bank will grant you a loan of $500,000/—at an annual interest rate of X%.

According to our terms and conditions, you must pay the first instalment of your loan amounting to $15,000/- within 30 days after the bank releases the principal amount to your account. You are supposed to make your monthly payment by the 25th of every month. Kindly go through the enclosed literature discussing the details of our terms and conditions and amortization rules. If you fail to abide by these rules, the bank will be authorized to take legal action.

Please fill out and sign the attached forms if you agree to our terms and conditions. Then, submit the forms to the bank as soon as possible so that we can proceed with your loan without any further delay.

Our customer care service is available between 8 a.m. and 6 p.m. to help you with your queries and issues. Please let us know if you require assistance.

- Authorization Letter for House Renovation

- Proposal Letter to Boss Suggest Moving Office to New Place

- Trailer Bill of Sale Template

- Bank Receipt Template for MS Word

- Summer Holiday Activity Calendar

- Program Catalog Template

- Warning Letter for Negligence in Work

- Warning Letter for Performance Issue

- Warning Letter for Unethical Abusive & Disruptive Behavior

- Project Execution Confirmation Letter

- Warning Letter for Inappropriate Behavior

- Job Accomplishment Recognition Letters

- Resignation Letter to Boss because Workplace is Horrible

- Emergency Leave Message for Father is Hospitalized

- Warning Letter for Disclosing Salary