Whenever a contract is opened or policies are distributed, it is ensured that everything is written or detailed minutely and signed by all the parties involved. This helps in the legality of any problem that may arise afterward or as to what course of action should be adopted in case one of the parties default to abide by the contractual agreement. Even after all the efforts and necessary steps are taken, situations do arise where either the borrower or the lender fails to fulfill their part of the agreement. In such a case, a letter of explanation is required to forewarn and further elucidate the terms and agreements for better foreclosing of the contract.

The same is the case with mortgage deals where a lot of details need to be incorporated for making the problem, as well as the course of action, crystal clear to both the lender and the borrower.

A letter of explanation (LoE) is a letter that is written by a company (lender) to its client (borrower) to get specific information about the payment plans. The letter also asks about the unprecedented delays in payment and timelines for a further action plan. This letter is necessary to clarify any discrepancies and complete the mortgage process.

Information that a Letter of Explanation for Mortgage Lender contains

A letter of explanation must be as detailed as possible and should contain the following information:-

- The company’s information, name of the lender.

- Date when the letter is written.

- References for any other correspondence that you might include in your letter’s body.

- Mortgage Policy Number, date of opening the policy, bank account details, etc.

- The subject and the main body of the letter.

- The borrower details, current address, phone number, etc.

Sample Letter

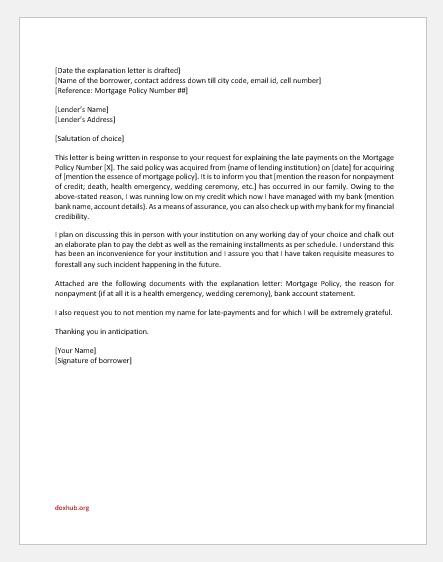

[Date the explanation letter is drafted]

[Name of the borrower, contact address down till city code, email id, cell number]

[Reference: Mortgage Policy Number ##]

[Lender’s Name]

[Lender’s Address]

[Salutation of choice]

This letter is being written in response to your request for explaining the late payments on the Mortgage Policy Number [X]. The said policy was acquired from {name of lending institution} on [date] for acquiring of [mention the essence of mortgage policy]. It is to inform you that [mention the reason for nonpayment of credit; death, health emergency, wedding ceremony, etc.] has occurred in our family. Owing to the above-stated reason, I was running low on my credit which now I have managed with my bank {mention bank name, account details}. As a means of assurance, you can also check up with my bank for my financial credibility.

I plan on discussing this in person with your institution on any working day of your choice and chalk out an elaborate plan to pay the debt as well as the remaining installments as per schedule. I understand this has been an inconvenience for your institution and I assure you that I have taken requisite measures to forestall any such incident happening in the future.

Attached are the following documents with the explanation letter: Mortgage Policy, the reason for nonpayment {if at all it is a health emergency, wedding ceremony}, bank account statement.

I also request you to not mention my name for late-payments and for which I will be extremely grateful.

Thanking you in anticipation.

[Your Name]

[Signature of the borrower]